In 2023, global aerospace insurance faces huge challenges. Due to multiple spacecraft failures, insurance companies are expected to lose more than $800 million, which is higher than the premium income, and will inevitably have a significant impact on the industry. As we all know, rockets and various spacecraft may encounter various risks during the manufacturing, launch and in-orbit operation, causing property damage and even personal injury. For this reason, aerospace insurance came into being. By providing compensation for various risks, space launch activities can obtain a "safe haven", which is also an effective way to reduce risks, compensate for losses, and ensure the sustainable development of the aerospace industry

Covering the entire life cycle

The aerospace engineering system is huge and can be regarded as one of the most complex system engineering in human history, with obvious high-risk, high-tech and high-value characteristics. For this reason, the United Nations 1967 Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies (referred to as the Outer Space Treaty) and the 1972 Convention on International Liability for Damage Caused by Space Objects (referred to as the Liability Convention) successively established the national liability system of the launching state. This means that each contracting party shall bear international responsibility for its activities in outer space, including activities carried out by national government departments and activities carried out by non-governmental groups and organizations. In view of the huge pressure on the state in terms of space compensation liability, countries generally require that their space activities must purchase third-party liability insurance and other related insurance.

With the rapid development of space technology, the risks faced by space activities cannot be ignored, which has promoted the vigorous development of the space insurance market. The main risks of space activities include spacecraft explosions, malfunctions, accidental failures, climate factors, and accidental collisions of spacecraft. The division of aerospace insurance liability is usually based on the contract agreement. During the validity period of the insurance, the insurer (usually an insurance company) shall bear all or part of the losses during the operation of rockets and spacecraft.

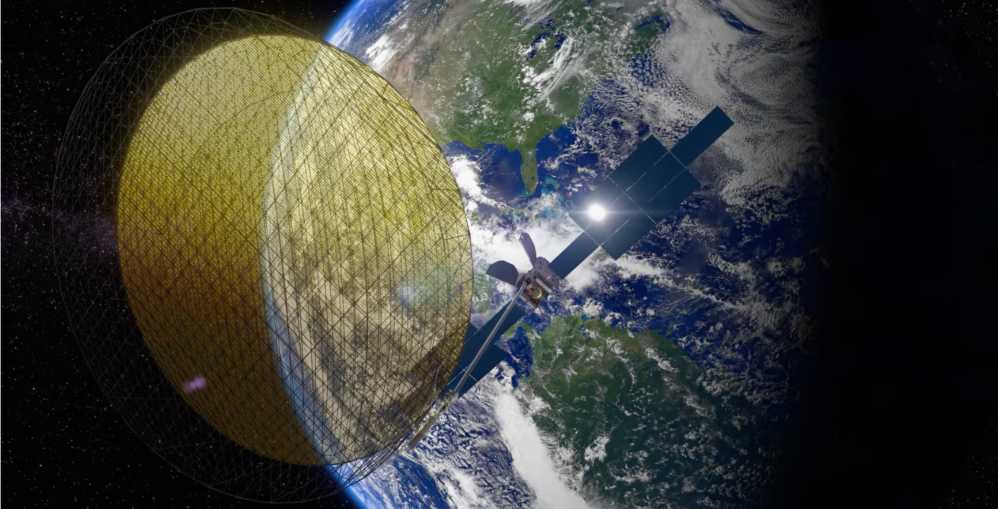

Commercial aerospace satellite projects generally purchase aerospace insurance, mainly involving the launch and operation of geostationary orbit communication satellites and civil remote sensing satellites. According to the stage of project progress, aerospace insurance can be divided into insurance for the manufacturing stage of rockets and spacecraft, pre-launch insurance, launch insurance, spacecraft in-orbit life insurance and third-party liability insurance, covering the entire life cycle of aerospace engineering projects from factory delivery, hoisting, transportation to launch and in-orbit operation, which are specifically divided into 5 categories.

First, in the manufacturing stage of rockets and spacecraft, the aerospace insurance method is similar to other property insurance. The main risks covered include the risks during the manufacturing and installation of rockets and spacecraft and the testing risks of various components. The insurance period usually ends when the rocket and spacecraft are hoisted onto the transportation vehicle and prepared to be transported to the launch base. This part of the insurance is usually purchased by the rocket manufacturer.

Secondly, in the pre-launch phase, aerospace insurance mainly covers several important phases: the phase when the rocket and spacecraft are transported from the manufacturing site to the launch base, the temporary storage phase at the launch base, the docking phase, and the refueling phase. In these phases, losses caused by accidental accidents such as fire, explosion, and destruction, as well as risks such as emergency shutdown of the engine after the rocket is intended to ignite, and failure to detach from the launch arm, are all covered by aerospace insurance.

Third, in the launch phase, aerospace insurance mainly covers the launch of the spacecraft from the ignition of the rocket to the scheduled orbit and the implementation of in-orbit testing after the fixed point, until it is delivered for use.

It should be noted that the time when the manufacturer transfers the risk to the user is not exactly the same depending on the delivery method. In the ground delivery contract, the risk division point between the manufacturer and the user is the ignition moment of the first stage of the rocket. In the orbital delivery contract, the manufacturer’s risk will end at a certain moment when the spacecraft is tested on-orbit and officially delivered to the user. The two parties can agree on a certain day after the spacecraft enters orbit.

Fourth, in the on-orbit stage, aerospace insurance is mainly responsible for compensation for abnormal conditions that occur within a certain period of time after the spacecraft enters the predetermined orbit and begins normal operation, and fails to meet the predetermined working requirements or is difficult to reach the predetermined working life, causing losses. As for the abnormal conditions that occur in the spacecraft on orbit, they mainly include transponder failure, battery failure, solar power supply system power decline, fuel leakage, etc.

Fifth, aerospace insurance also includes third-party liability insurance, which is mainly responsible for compensating for personal injury and property losses caused by objects falling from rockets and spacecraft during and after the launch.

Different from common property insurance, due to the high value and concentrated risks of aerospace engineering, aerospace insurance is generally jointly insured by multiple insurance companies. For various reasons, each aerospace project is generally insured by different co-insurance companies. In the actual operation, the chief underwriter of the space insurance project is very important. Generally, he represents the joint guarantee group to connect with the space customers and provide a series of services, including "tailor-made" underwriting plans, underwriting policies, docking within the validity period, and claims settlement.

It is worth noting that there are no unchanging insurance policies and fixed rates in this field. The underwriting of each space project reflects the concept of "tailoring to the needs". This is the most significant feature of space insurance that distinguishes it from other types of insurance.

Take the space station crash as an example. In March 2001, the Russian space officials signed an insurance agreement worth US$200 million with relevant insurance companies to compensate for the damage that the Mir space station might cause to third parties when it crashed into the South Pacific. The insurance premium accounted for 0.3%~0.7% of the total insured amount. At that time, the London branch of the French insurer AGF and several companies of the British Lloyd’s consortium jointly provided insurance services for the Mir space station crashing into the sea.

Development twists and turns and falls into a trough again

The birth and ups and downs of space insurance are closely related to the development of the space industry.

In 1965, the National Satellite Communications Consortium of the United States hoped to reduce the launch risk and insured the Morningbird satellite. Since there were few satellite launch activities related to space insurance at that time, the relevant information and basis for accurate risk assessment were also quite scarce. The insurance company only provided $5 million in pre-launch insurance and $25 million in third-party liability insurance for this launch. The coverage of the policy only includes third-party liability insurance and pre-launch insurance, and does not cover launch insurance and satellite in-orbit life insurance.

After that, as the number of satellite launches increased, the insurance company’s risk assessment level continued to improve and the coverage of space insurance gradually expanded. At the same time, driven by interests, insurance institutions in the United Kingdom, the United States, Japan, France, Germany, Italy, Canada and other countries have entered the field of space insurance. Since the 1970s, with the continuous improvement of spacecraft technology such as rockets and satellites, space insurance has gradually been accepted by mainstream insurance companies around the world, underwriting plans have been gradually optimized, and underwriting capacity has been greatly improved.

However, the inherent high-risk nature of space activities means that the development of the space insurance industry will not be smooth sailing. Two accidents in 1977 and 1979 caused the entire space insurance industry to be unable to make ends meet, and the space insurance market was forced to reshuffle. In the 1980s, a series of satellite accidents and launch accidents brought great pressure to the space insurance industry.

It should be noted that for decades, the proportion of space insurance premiums to policy costs has continued to decline, accounting for only 5% to 20% of the policy cost, or even lower.

In 2018-2019, the space insurance industry suffered a heavy blow. In 2018, with space insurance premiums of only US$450 million, the compensation was as high as US$600 million. 2019 was a year of "adding insult to injury" due to the continuous occurrence of major losses in space activities, with compensation of $800 million. Some industry insiders pointed out that in the past two years, not only did the aerospace insurance payout rate far exceed 100%, but it also "emptied out the insurance company’s premium accumulation for nearly 10 years", which directly led to the withdrawal of traditional aerospace insurers such as Swiss Re, and the overall aerospace insurance rate tended to increase.

In 2023, the global aerospace insurance industry fell into a trough again. Multiple failures of spacecraft caused aerospace insurance companies to expect losses of more than $800 million and premiums of about $550 million.

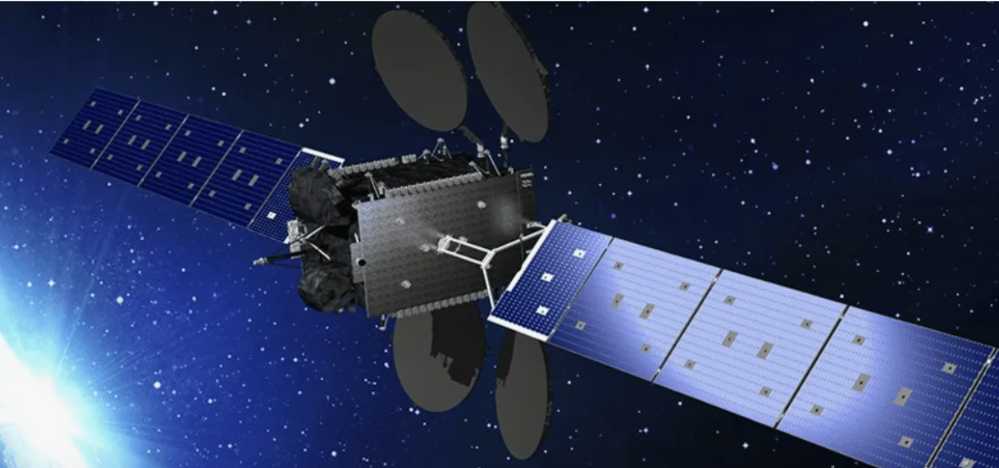

For example, the "International Mobile Satellite" 6F2 of the US Viasat Company carries L-band and Ka-band payloads, designed to provide mobile communication services to aircraft and ships, with a launch mass of nearly 5.5 tons and an insured amount of $350 million. However, the satellite encountered an abnormality during the orbit raising process and could not complete the mission normally.

The company’s Viasat-3 Americasat is known as the "most powerful communications satellite" and is designed to have a single-satellite capacity of up to 1 terabit/second, but it encountered problems with the deployment of the main antenna, and the available capacity is expected to be reduced by more than 90%. As a result, insurance companies are facing a record claim of $420 million. In addition, the solar cells of the Arcturus satellite that was put into orbit with Viasat-3 Americasat also had problems, which may lead to a claim of $40 million. In September, the launch of the US Electron rocket failed and the radar imaging satellite was lost, which may trigger a claim of about $5 million. Azerbaijan’s first Earth observation satellite Azersky/Spot-7 malfunctioned 9 years after it was launched into orbit, with an estimated loss of about $25 million. In addition, problems with the propulsion systems of four geostationary orbit satellites using the same type of power processing unit from Northrop Grumman are expected to trigger claims of more than $50 million.

Although many aerospace claims in 2023 are still under finalization, they are likely to cause the worst annual losses in the global aerospace insurance market in nearly 20 years. Considering that the performance in this field in the previous seven years was "very mediocre" and insurance companies were "almost unprofitable", the losses in 2023 will undoubtedly have a major impact on the aerospace insurance industry, causing some insurance companies to consider exiting the industry, and many practitioners are forced to reassess how to handle related businesses, including what types of risks will be covered and how much premium will be charged.

New needs and new topics

After decades of development, aerospace insurance has formed a certain scale, and the business scope and model are relatively solidified. With the rise of commercial aerospace, large-scale low-orbit constellation construction is in full swing, and space tourists and private astronauts are flying more and more frequently, which has given rise to new industry demands and the aerospace insurance industry is also facing new topics. The geostationary orbit satellite insurance market is relatively well developed, and most satellite operators will purchase standard insurance packages for a period of one year of satellite launch and in-orbit operation, and then renew them once a year. However, the low-orbit satellite insurance market is relatively complex because low-orbit constellations use many new technologies, and insurance companies can refer to fewer similar in-orbit data. At the same time, whether satellite operators purchase insurance is related to their own risk tolerance. Operators of giant LEO constellations are likely to expect that only a few satellites will fail, so it doesn’t make much sense to purchase insurance for each satellite. Considering that the production cost of each LEO satellite is much cheaper than that of large geostationary orbit satellites, it is also easier to launch LEO satellites to replenish the network, so the overall loss is relatively small.

In addition, there are differences in the financing models of geostationary orbit satellites and LEO satellite operators, which means that the former are more likely to purchase aerospace insurance. When a mature geostationary orbit satellite operator wants to launch a satellite worth $100 million, it will build the project through loans and other means. In the loan terms, investors usually require the operator to insure the satellite. After all, most of these investors are "conservative" institutions such as banks, hoping to obtain insurance compensation after the mission fails. In contrast, LEO satellite operators are often supported by venture capital, attempting to seize the market by rapidly building constellations, and investors in these projects are more willing to bear possible risks.

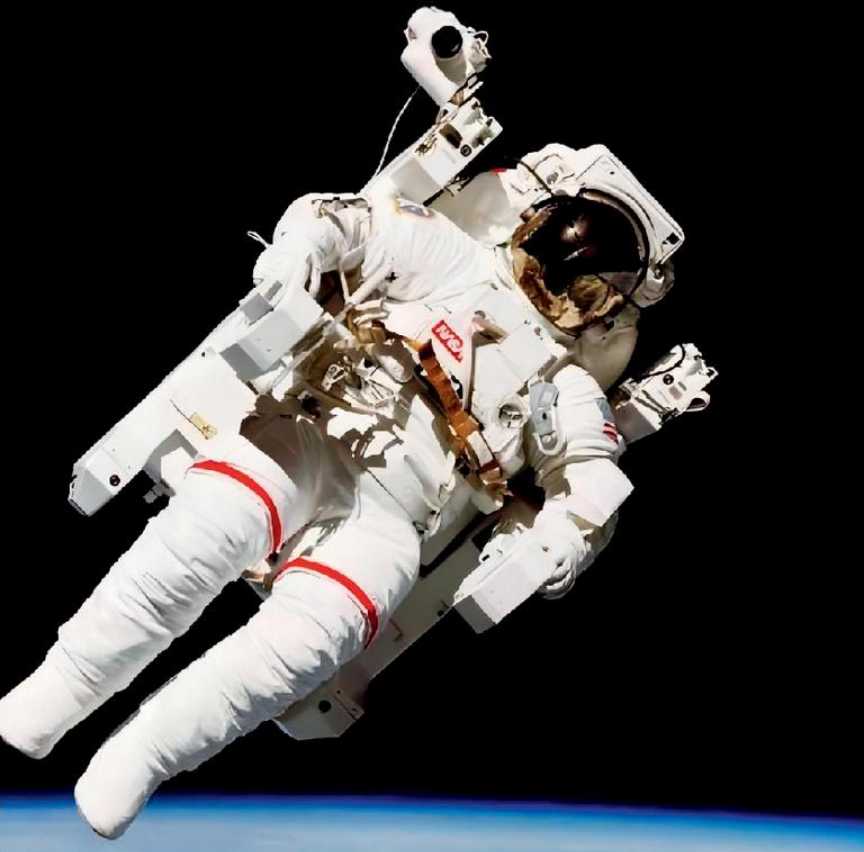

Although insurance companies are famous for guaranteeing "weird and adventurous behavior" at high prices, commercial manned spaceflight is not within their business scope for the time being. Space insurance professionals explained that this is mainly because commercial manned spaceflight or space tourism involves many high-risk factors, and it is still not an area of particular concern for life insurance companies, not to mention that there are not many people entering space and the market size is not large.

For example, the current size of the space insurance market for satellites, rockets, etc. is about US$500 million per year, but there is no law requiring operators such as Blue Origin to provide casualty insurance for passengers, nor does it require space tourists to purchase life insurance.

Since Gagarin’s first flight, hundreds of astronauts from different countries have entered space in national projects. The United States has the most astronauts entering space, but the U.S. government and NASA generally do not purchase liability insurance. The cost of official launch activities is basically borne by taxpayers, and NASA astronauts enjoy government life insurance plans.

In recent years, commercial manned spaceflight has gradually increased, and it is estimated that commercial space travel companies will provide passengers with waiver contracts - if a passenger dies during flight, the company will not bear any responsibility.

However, NASA is vigorously promoting the commercialization of the International Space Station, including cooperating with commercial companies to carry out private space tourism and other activities, and at the same time calling on the insurance industry to establish an insurance mechanism for privately funded manned missions to the International Space Station, including requiring private astronauts to purchase life insurance.

Currently, the only mandatory insurance for commercial space operators is third-party liability insurance. People in the insurance industry said that a key issue facing the industry is: Do the risks associated with space tourism belong to space insurance or aviation insurance?

The first aviation insurance policy was signed by Lloyd’s Insurance Company of the United Kingdom in 1911. Since then, the aviation insurance industry has developed steadily. At present, some space companies are organizing suborbital commercial tourism, and passengers will return to their departure point. Technically, this is a "domestic trip" and is not subject to international aviation insurance principles. The insurance industry has received inquiries for insurance for suborbital flight missions. Some people believe that aviation and aerospace "look very similar", and aerospace travel insurance can explore an operational model that meets market demand based on the reference of aviation insurance and its own characteristics.

In short, the aerospace industry and commercial insurance have gradually established an inseparable relationship. Aerospace insurance has become a unique insurance business in the international insurance market, which can ensure that the economic interests of buyers of aerospace products are not lost. Therefore, aerospace insurance is, to a certain extent, an important driving force for the development of the aerospace industry.

The global aerospace industry is in a new stage of great development and great change. Commercial aerospace companies have driven the continuous growth of global aerospace industry revenue with the help of technological and model innovation, and have also brought new challenges and opportunities to the aerospace insurance market.