Unlike Ukraine, which relies on Western military aid, Russia needs to produce its own weapons and ammunition. Since launching a "special military operation" against Ukraine in February 2022, Russia’s military spending has increased dramatically. However, through public Russian official documents, we can still get a glimpse of the many clues of the Russian military’s procurement of weapons through careful estimates, and make some judgments on Russia’s war potential.

What is the cost of the Su-57?

The Su-57 (NATO codename "Major Criminal") is Russia’s most advanced fifth-generation stealth fighter in service. According to the schedule announced by Russia, the Su-57 will be delivered to the 23rd Combat Aviation Regiment of the 303rd Mixed Aviation Division of the 11th Air Force stationed in the Far East in early 2023. However, as of now, the 9 Su-57s that have been delivered (the most recent 4 of which were delivered in December 2022) are still at the military test center in Akhtubinsk and the pilot training center in Lipetsk, and have not yet officially joined the Russian Aerospace Forces. However, this does not prevent the Russian side, especially the aviation industry, from boasting about it.

Since June 2022, Russian officials and business leaders have continuously declared in public that the Su-57 has appeared in the Russian-Ukrainian conflict, including launching new ammunition from its built-in bomb bay. For example, Yuri Slyusa, president of the United Aircraft Corporation of Russia, claimed in August 2022: "The aircraft is participating in special military operations and showing its best side." Although it is not possible to confirm this statement from the Russian side, it is certain that Russia will never let the new fighter Su-57 take the risk of flying over the Ukrainian-controlled area. If it did participate in the battle, it is likely to use long-range precision-guided weapons, such as R-37M missiles, to carry out long-range strikes on Ukrainian targets within Russian territory.

Whether the Su-57 has participated in actual combat, one fact is certain: the aircraft is currently Russia’s newest and most expensive fighter. The international arms sales market has different speculations about the price of the Su-57, and how much does the Russian Aerospace Forces need to spend to obtain this new fighter?

The most reliable information comes from the official report of Russian Defense Minister Sergei Shoigu’s visit to the Su-57 manufacturer Komsomolsk-on-Amur Aircraft Manufacturing Plant in August 2020. At that time, the factory showed Shoigu a poster showing that the purchase price of the first two Su-57s (completed in 2019 and 2020 respectively) was 4.7 billion rubles each (including 20% VAT). The poster also revealed that the price is expected to drop after the Su-57 is mass-produced in the future. According to the purchase contract signed by the Russian Ministry of Defense in June 2019, 76 Su-57s should be produced before 2028. If the contract is effectively implemented, the price will drop to 3.192 billion rubles per aircraft during the production process. It should be noted that this is only the purchase price of mass-produced aircraft, which does not include the cost of aircraft research and development, nor does it include the costs incurred by various preliminary preparations for mass production.

What is the price of Il-76MD-90A?

Il-76 is the main heavy transport aircraft in service of the Russian Aerospace Forces. In the Soviet era, the Il-76 was produced by the Chkalov Aircraft Manufacturing Plant in Tashkent, Uzbekistan. In 2006, the Russian government decided to produce the Il-76MD-90A transport aircraft at the Aviastar-SP Aircraft Manufacturing Association in Ulyanovsk, Russia. It should be emphasized that this is not a resumption of production, but a new factory in a new location to produce new modernized aircraft. The original production equipment of the Il-76 remains in Uzbekistan.

On October 4, 2012, the Russian Ministry of Defense ordered 39 Il-76MD-90A aircraft at one time, which were scheduled to be delivered between 2014 and 2020. The total contract price was 139.4 billion rubles, with an average unit price of 3.57 billion rubles per aircraft. However, the contract was not fulfilled, the delivery of the aircraft was significantly delayed, and the production was not completed before the deadline.

In April 2017, the Russian Ministry of Defense admitted that the main reasons for the delay were the high failure rate of the new equipment on the aircraft, the large number of modifications made by the Ilyushin Design Bureau during the production process, and the additional requirements of the military for the onboard systems. "The management of Hangxing-SP complained that due to Russia’s high inflation rate of 5% to 12% in recent years, the supply prices of secondary suppliers have risen sharply, making the production cost of Il-76MD-90A much higher than the original contract price, and the loss of each aircraft is as high as 1 billion rubles, so the factory requires a re-pricing. In the negotiations in May 2019, the Russian Ministry of Defense agreed to modify the contract terms and put forward new requirements for the design indicators of the aircraft, but the new purchase price was not disclosed.

What is the price of Ka-52?

The Ka-52 "Alligator" is one of the main armed helicopters currently in service in Russia. It is generally believed that the aircraft can compete with the United States. The Ka-52 is comparable to the AH-64 "Apache" and was once very popular in the international arms sales market. However, after the outbreak of the Russian-Ukrainian conflict, the Ukrainian army used a large number of portable air defense missiles, causing great losses to the Ka-52. According to statistics from Ukraine and the West, as of January 2023, the Russian army has lost more than 30 Ka-52s, while its pre-war production was 140-145. In other words, the Russian army has lost about a quarter of its Ka-52s.

Although such losses are still within Russia’s tolerance, its economic losses are still staggering. Even though the production cost of the Ka-52 is much lower than that of similar Western models, it is still worth a lot. According to a financial report in 2021 by the Ka-52 manufacturer Arseniev "Progress" Aviation Manufacturing Plant, the plant delivered 12 Ka-52s to the Russian Ministry of Defense that year, earning 11.497 billion rubles in revenue, an average of 958 million rubles per helicopter. In fact, a Ka-52 The production cost of the helicopter is said to be 1.177 billion rubles, and the factory will suffer a loss of 219 million rubles for each helicopter delivered, not including other costs such as value-added tax. In contrast, in 2015, Egypt ordered 46 Ka-52E helicopters from Russia. According to the transportation insurance bidding documents for a batch of Ka-52 helicopters delivered by Russia published in April 2019, the price of each helicopter was 1.102 billion rubles, which was equivalent to 17 million US dollars based on the exchange rate at the time, which means that the cost of Ka-52 even exceeded the export price! Unexpectedly, it is not uncommon for the Russian Ministry of Defense to purchase weapons at prices lower than the production cost. However, Russian military-industrial enterprises have to endure this unreasonable procurement method because since the United States passed the Countering America’s Adversaries Through Sanctions Act 》, Russian weapons suffered a major setback in the international arms market, and the Russian military became the only buyer for many companies. Of course, the Russian government also tried to compensate these companies, such as helping them repay or reduce debts owed to state-owned banks. The Russian government cannot allow its military-industrial enterprises to go bankrupt, but how long can this approach last?

Prices of other military aircraft

According to public Russian official documents, the military aircraft whose costs can be confirmed are limited to the above models. Although the price costs of other Russian military aircraft can be obtained through different channels, they are not authoritative.

From the current information, Russia’s most expensive military aircraft is the Tu-160M "Pirate Flag" strategic bomber. On January 25, 2018, Russian President Putin attended the order signing ceremony held in Kazan. After the contract was signed, he revealed to the outside world that the Ministry of Defense purchased "10 Tu-160Ms, with a unit price of 15 billion rubles, or even higher, and the total contract price exceeded 160 billion rubles." If estimated by purchasing power parity standards, the price of each Tu-160M will reach more than US$500 million.

In addition to the Tu-160M, the price level can also be understood from the many lists of military aircraft sold abroad announced by Russia. For example, the Be-200ChS amphibious aircraft, a military firefighting and search and rescue aircraft that Russia began to produce in 2022, has an export price of 2.64 billion rubles, and the simplified Be-200T (without firefighting function) based on it has a price of 2.005 billion rubles. Another document mentioned that when the Russian special forces purchased the Mi-8AMTSh-VN helicopter, the unit price given was 1.015 billion rubles.

What is the price of the R-77-1 missile?

Compared with the high-cost air combat platform, the unit price of airborne weapons is much lower. Missiles, precision-guided bombs and other weapons require a large amount of reserves and are consumed quickly on the battlefield. Therefore, their procurement costs account for a considerable proportion of the total military expenditure. The purchase of the R-77-1 missile (NATO code name AA-12B "Viper") by the Russian Ministry of Defense can prove this.

The R-77-1 beyond-visual-range air-to-air missile is a new type of missile developed by the "Signal Flag" scientific research and production association based on the R-77. It is also the main equipment of the Russian Aerospace Forces. In 2018, "Signal Flag" signed a contract with the Russian Ministry of Defense for a period of 5 years with a total price of 64.88 billion rubles. In 2019, because "Signal Flag" failed to deliver 10 missiles on time, the Russian Ministry of Defense filed a breach of contract lawsuit against it, demanding that "Signal Flag" pay 299 million rubles in compensation. From this, we can know that the price of an R-77-1 is about 29.9 million rubles.

Based on this price, we can also estimate the production capacity of the R-77-1 missile. According to the total value of the 5-year contract from 2018 to 2022 of 64.88 billion rubles, if the purchase price remains unchanged, 2,170 missiles can be purchased, with an average annual production of about 430 missiles.

What is the price of the LMUR missile?

The LMUR light multi-purpose missile (internal number "Product 305") is Russia’s newest and most advanced anti-tank weapon. It has been mass-produced for 5 years and can be mounted and used by helicopters such as Mi-8MNP-2, Mi-28NM and Ka-52M, and has been put into actual combat on the battlefield in Ukraine. The LMUR missile weighs about 105 kg: twice as heavy as the anti-tank missiles used by Russian helicopters in the past, and has a range of up to 15 kilometers. Through another lawsuit filed by the Russian Ministry of Defense, we can get a glimpse of the price of the LMUR missile. As the manufacturer of the LMUR missile, the Kolomna Machine Building Design Bureau signed a production contract with the Russian Ministry of Defense in 2018 for a total price of 1.807 billion rubles, of which 30 missiles should be delivered in 2018. For unknown reasons, the Kolomna Machine Building Design Bureau failed to fulfill the contract and was sued by the Russian Ministry of Defense. According to the compensation proposed by the Russian Ministry of Defense, the cost of one LMUR missile is about 14.2 million rubles (including 18% VAT). According to the contract period and total price, if it is a fixed price, this expenditure can purchase 127 LMUR missiles, and the production batch in 2018 is 30, so it can be inferred that in the remaining two years, the Kolomna Machine Building Design Bureau will produce about 50 missiles per year.

The mystery of Russian weapons costs

In November 2022, the Ukrainian edition of Forbes magazine released an analysis report showing that since the Russian-Ukrainian conflict, the Kremlin has spent $82 billion in 9 months, of which $16 billion was used to pay military salaries and more than $9 billion was used to support the families of fallen soldiers. In addition, the report also pointed out that the technical equipment lost by the Russian army would reach $21 billion in money.

So, how much equipment did the Russian army lose? This is a difficult mystery to solve, because it is impossible to get an accurate answer by calculating the exchange rate between the ruble and the dollar. Take the Il-76MD-90A transport aircraft as an example. According to the current market exchange rate, the price of this type of aircraft was US$115 million in 2012, and only US$51.3 million in 2020: Even if Russia has maintained a high inflation rate in recent years, it is unlikely that such a huge price difference will occur. In fact, domestic transactions in Russia are purchased in rubles, and the price will not change significantly.

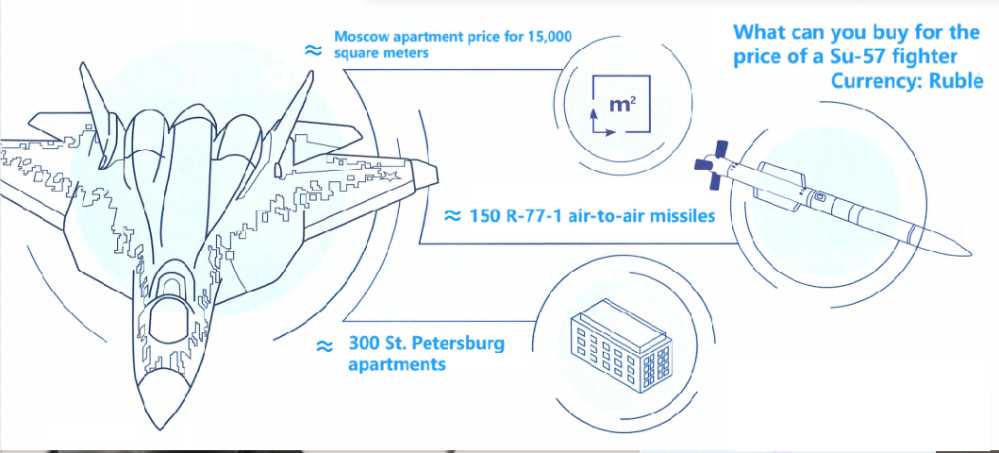

Therefore, some kind of reference can be used as a price reference for Russian weapons. For example, it is a good method to convert the ruble price of weapons purchases into the number of apartments purchased in Russia. At present, the average house price in Moscow is 300,000 rubles/square meter, St. Petersburg is 200,000 rubles/square meter, and other major cities in Russia are around 100,000 rubles/square meter. According to this price, it costs 15 million rubles to buy an apartment with an area of 75 square meters in St. Petersburg. Based on this calculation, purchasing a Su-57 can buy more than 300 apartments; purchasing a Ka-52 helicopter can buy 80 apartments; purchasing an R-77-1 air-to-air missile can buy 2 apartments.

However, this reference method cannot really measure the cost of Russian weapons. If you want to further clarify, you can also use "purchasing power parity" (PPP) as an exchange rate measurement indicator. However, in this way, the purchase price of Russian weapons will rise sharply, which is 1.9 to 2.3 times the actual exchange rate price of the US dollar.

However, this reference method cannot really measure the cost of Russian weapons. If you want to further clarify, you can also use "purchasing power parity" (PPP) as an exchange rate measurement indicator. However, in this way, the purchase price of Russian weapons will rise sharply, which is 1.9 to 2.3 times the actual exchange rate price of the US dollar.

Other factors affecting prices

In addition to factors such as inflation and procurement system, the increase in production costs of Russian military enterprises is also affected by other factors. For example, the economic sanctions and trade embargoes imposed by Western countries on Russia have seriously affected Russia’s supply capacity to its troops. In particular, Russia’s inability to obtain various parts from the West has seriously restricted the production capacity of precision-guided munitions and advanced electronic equipment platforms. According to Russian media reports, the development of the new generation of An-100 early warning aircraft has been greatly delayed due to the lack of electronic components such as chips. Sanctions from the West not only affect the supply chain of Russian military enterprises, but will further increase the cost of various weapons, including military aircraft and missiles.

In addition to the impact on war, the destruction of the military industry chain will even cause irreparable damage to the entire Russian military industry system. If Western parts cannot be supplied normally, many of Russia’s weapon systems, especially those for export, will not be delivered on time. In the long run, it will inevitably affect the international reputation of Russian weapons. Under the pressure of the United States everywhere, if even the ability to deliver on time is lost, then the Russian-made weapons that once sold well in the international arms market will soon be replaced by weapons from other countries.

Of course, under the current circumstances, Russian military enterprises can still be maintained through military orders. However, Russia’s fragile economy has been greatly affected by the Russian-Ukrainian conflict. Especially in the case of a sharp increase in energy exports in 2022, Russia’s budget deficit will still reach 3.3 trillion rubles, and GDP is expected to fall by 2.5%. If this trend continues, the Russian government will be unable to continue to support military enterprises in the future, and it is likely to fall into the same predicament as in the early 1990s, with difficulty in controlling production costs and shrinking production capacity.

Conclusion

For a long time, Russia’s military aircraft have been able to stand on equal footing with the United States and Europe in the international arms market, and even once were comparable to the United States. However, when Russia publicizes to the outside world, it often emphasizes the excellent performance of military aircraft and the comprehensiveness of supporting weapons, but selectively avoids talking about its biggest advantage-price. For example, although the unit price of the first batch of mass-produced Su-57 fighters is as high as 4.7 billion rubles, it is only 65 million US dollars when converted into US dollars, which is cheap compared to the F-35A’s once high price of 100 million US dollars. Therefore, Russia’s weapon costs are not too outrageous, allowing it to withstand the huge financial pressure brought by the war for a certain period of time.

Of course, Russia’s current weapons production capacity is indeed affected by Western economic sanctions and trade embargoes. Since June 2022, Western and Ukrainian media have been constantly throwing out the argument that Russia’s arsenal of ammunition is running out. However, what is ignored by the Western media is that Russia has been preparing for war as early as 2021.

In 2020, Russian military enterprises were still suffering from a serious lack of operating rates. Not only did they change their working hours to a four-day work week, but they also laid off a large number of older employees. However, in 2021, many Russian military enterprises have already required all employees to return to work and resume production. By the beginning of 2022, major Russian military enterprises not only needed to work in three shifts day and night, but also began to recruit more workers. For example, the Votkinsk plant that produces the "Iskander" missile quickly added 500 jobs.

This situation occurred because of a surge in war orders. According to relevant statistics, Russia’s defense spending increased by 180% from February to April 2022 alone, of which spending in April 2022 increased by 38% compared with the same period in 2021. Andrei Yelichaninov, the first deputy chairman of the board of directors of the Russian Military-Industrial Committee, even announced that military orders in 2022 will increase by 600-700 billion rubles.

While the operating rate and funds are effectively guaranteed, Russia’s efforts to find alternatives to Western parts have also achieved certain results. At least parts from Russia’s "friendly countries", such as Belarus, have helped a lot. At the same time, Russia’s self-developed parts have also made up for the gap to a certain extent. In addition, Russia continues to obtain parts from the West through certain special channels. Of course, it is not known how long these measures can allow Russia to fight the war, and they are still holding on for now.